Research

Why is market research important?

The research is the longest and hardest part of the entire process. Knowing what signs to look for and diagnosing the figures from many different sources can take weeks at times. It’s the parameters that we use that allow us to get in before the market starts to jump.

Let us make one thing very clear though…We don’t buy in Hot Spots…. If you are buying in a “Hot Spot” then you are the type of investor who is making us (and our clients) money.

wHy?

Well, the market has already jumped up in value. They use lines like – Better get in now before you miss the boat… FYI you already have!

Once we have identified a possible great investing location, it’s time to spend considerable time on ground to give our last list of criteria points the tick of approval. And that very last criteria is gut feel… Yes that’s right.

“Local knowledge” is an important part of the research but must be taken with a grain of salt. Sometimes locals read too much into hearsay info they have heard that may or may not be 100% correct. This info comes from real estate agents, property managers and pest inspectors.

We strongly value this information because if we are going to put our own hard earned money into investing there ourselves, then we want to get a good feeling about the location. We have walked away from several potential investing locations due to this feeling. And I am talking about locations as big and known as Newcastle, Whyalla, several suburbs in the outer Melbourne metro area.

But now to the crux of it all, what is the main criteria we look for:

Our criteria consists of three main points when locating suitable areas to invest in. Once a location meets these three hurdles, the research becomes more refined and specific to location. But let it be known that these three search criteria’s alone will put you into some great investing locations.

Todd Hunter has put together an ebook providing you with the secrets from his latest location he’s finished buying in from 2014/15. Download your copy today!

Supply & Demand

For property values to increase there must be demand. If demand outways supply then property prices increase.

The same is true in reverse too… if supply outways demand then property prices will plummet.

To calculate these ratios we must know the population growth of the location along with potential new developments. This info is free and can be accessed through the Census website along with local Council websites.

Using population stats alone can be a huge mistake. For example, in the 2011 Census, a few Shires in Melbourne were the highest locations in Australia for population growth. They were strongly publicized across many media outlets as strong investing locations, but are they really?

They were Werribee, Whittlesea, Pakenham, and Melton. The reason for this was because House and Land companies were building affordable new entry point housing suburbs on newly subdivided farmland and attracting many new families to the area. So of course population stats would look fantastic and the outskirts appear to be the place to invest. Clever marketing also plays a big part here in luring in the buyers.

The issue being, that these companies were building far more homes than the area required, creating a huge oversupply. Far more houses than the population increase can buy or rent.

This one reason alone has seen yields plummet and vacancy rates rise dramatically wHere yields are around 4% and below. A quick search on realestate.com.au will show you how many houses are for sale. This is a real problem for these locations as they will not see any capital growth for years to come. There are other issues like transport that also add to the problem as well.

On the reverse of this were high population growth locations like Mandurah, Kwinana, and Armadale, all in WA. They too all have a population growth of over 5% but are only building small amounts of new homes. Well under the desired supply required. As a consequence, this massive undersupply has seen yields jump up to mid-6% and property prices increase significantly in the past 12 months (2014), with no end in sight.

No surprise that wHeregroup was investing in all three locations long before the 2011 Census stats became public knowledge?

How?

We look for trends in past Census figures along with using Demographers reports.

Population forecasting is also a handy tool to research & understanding the future population growth of a location. Getting reports from Demographers is where this info can be obtained but is generally not free of charge. We only get these reports last once all the other criteria have been met. We find they are more of a reconfirmation than a deal breaker.

Get this ratio right however and watch yields increase 5%-10% per annum… yes per annum!

Price Point

We only invest in houses, not units, townhouses or duplexes as we do not like strata. It’s a cost that you cannot control. Often Strata fees increase and extra levies must be raised to build up a sinking fund for repairs in the future.

I am yet to see a new high rise unit complex that has not had their strata fees increased from the proposed fees after the first year and generally again in the second.

How can you work out whether the property is going to be a sound investment if you don’t know the ongoing costs associated?

So for this reason we invest in houses and in two price points.

- Up to $300,000

- $300K to $350,000

- $350K to $400,000

- $400K to $450,000

- $450K to $500,000

Please note; we do not have locations in every price point at all times. At no point will we ever purchase a house for $375k in a location that our research states we should only be buying for $330k.

Please let it be noted that the above price points are our maximum purchase prices and that if we find a location that offers all the potential of great capital growth with a good yield in houses under $300k then we will have no hesitation in investing there. In fact we prefer this.

wHy do we invest in the lower price points?

There are several reasons, so here we go:

It is an affordable level for all investors to be able to buy in. It makes no sense to me to buy an investment property worth $700,000. I would rather buy 2 properties totaling up to $700,000.

wHy?

I don’t want all my eggs in the one basket.

If we own 2 properties and one tenant moves out, then we still 1 tenant covering half of the loan repayments. We can cover the shortfall during this time. But if the tenant in our $700,000 property moves out, then we must cover then entire loan and generally this is not affordable nor sustainable, especially if we have a home mortgage or paying high rent ourselves. If the vacancy goes past 2 weeks then the first thing we do is drop the rent to simply get a tenant in. Defeats the purpose of investing in the first place, doesn’t it?

These price points allow you to take advantage of properties in different locations, by buying multiples and riding the different property cycles. For those active investors that want to become a little more aggressive in investing, we simply suggest buy multiples in each location. But we always stick to the plan.

All too often investors buy where they know – in their immediate area. This can be a fatal mistake and all too often it’s where real Estate agents invest because they believe they know their area best. The problem with investing this way is that they are susceptible to the market conditions of that location and that location only. Meaning that when that location performs well, all of their properties perform well but when the location cools off and is dead for a period of time and decreases in value, so does their entire portfolio.

When we invest we want to know that the vast majority of tenants can afford to rent a property at that price. This means that your property will have the lowest vacancy possible over the entire time frame that you own it. This price point also means that when you sell the property the vast majority of buyers are able to purchase the property from you. The price points we invest in are directly available to First Home Buyers FHB, 2nd Home Owners and investors.

Investing in properties that are in areas where the majority of the properties are selling between $300,000 & $500,000 and buying one for $800,000 will cause you problems with getting tenants who can afford that level of rent along with vastly narrowing down the number of potential buyers who can afford to pay that much for a property in years to come.

We also want to be buying the types of properties that the vast majority of people living there want to live in too. No point buying 2 bedroom units if the majority of the families that live there are families of four people.

When we invest we always invest with selling in mind. Irrespective of whether you intend to sell in the next year, 5 years or 20 years, the peace of mind of knowing that you can sell your property relatively easily is a safe low risk way to invest.

You never know what’s around the corner.

For those who are looking to build a portfolio, this is very achievable at this price point. We are controlled aggressive investors ourselves but only under the strict criteria mentioned here. To be more aggressive we simply buy more of the same low risk houses.

Yet we want to have a passive income…

Ok with interest rates low almost every property we purchase in cash flow positive.

What this means is that that the rent does NOT cover the interest payable on the loan but when you factor in some small negative gearing along with the depreciation you receive on the property, you make an income.

So yes you can have your cake and eat it, but for those high income earners, you need to be investing in multiple properties to increase the tax dramatically.

But be warned though, if your property becomes positively geared, then you will be paying income tax on the rent you earn… but isn’t that the point?

Don’t we all want an income that we can rely on that could replace our 9-5 job?

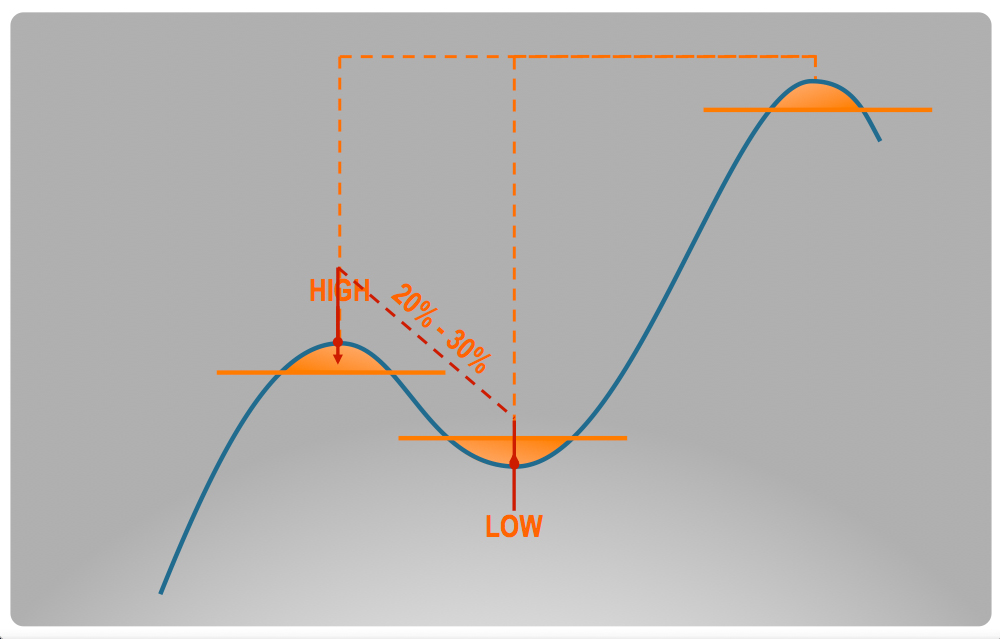

If you look at property cycles over the long term you will see highs and lows. The obvious thing is to buy in the low and sell in the high.

If it’s so simple then why doesn’t everybody do this?

We do… that’s exactly what we do!

That’s exactly what Warren Buffett does with shares!

Many Property Companies and Buyers Agents claim they do and often market to the media that they do, yet I never see them at any of my secret investing locations. At any given time there are only a few of these spots around Australia, yet they claim to buy for clients this way.

We adopt the Warren Buffet mentality to property as he does to shares. We follow the markets that offer all of the above PLUS have decreased in value over a 3 to 5+ year period.

Now we can never guarantee that we hit the exact rock bottom in the cycle but what we also have up our sleeve, is the extra buying powers you have in a property trough.

wHy are certain locations in a downward price trend?

Simply because they have passed the line of affordability where purchasers can no longer afford to buy them. This is made up of income, interest rates, people per family and purchase price, but in English, if they can no longer afford to buy that property at the high price they cant even make an offer.

These downward trends tend to last between 3 and 7 years but 5 years is a good medium to use.

When a market cools off, buyers disappear and houses do not sell. Desperate vendors start to reduce their price in order to meet the market and a downward spiral starts to take off. When we believe the bottom is close we come in and make low offers on ALL suitable properties.

We don’t have competition with other buyers, as there are very few around. So if vendors want to sell they must meet our market offers or be very close to. We have choice and time on our side.

The great part of the cycle, which generally goes undetected by many investors is that while prices are going down, rents are going up. They aren’t opposite in cycle, but more offset.

The reason for this is because land developers do not develop new blocks of land in a downward cycle.

wHy not?

Well if they do and develop a paddock of land into 60 new residential blocks they must then pay 60 sets of council and water rates. This becomes very expensive for land that isn’t selling.

With no new houses to accommodate all the people moving into that location, a rental frenzy starts to occur and we see rents increase in value quite fast. There is no quick solution to this frenzy either as land developers wait til they see the first signs of an upward property cycle before they start to develop. This can take a year, then the blocks sell off the plan and then to construct a house can take another year.

So with prices down and yields up, it makes for some great investing to be had.

We only buy established houses in established neighbourhoods. And funny enough we often buy the ex house and land packaged houses 5 to 7 years after investors buy them. Quite often investors are lured into the locations with new house and land packages and do not realize that there are huge kick backs on these properties, up to $60,000 we have personally seen. Not only are these investors being ripped off but the developer has many houses being completed at the same time and the only way to tenant these properties is fill them with undesirable tenants. After having paid too much for the house and watching the value fall dramatically along with experiencing bad tenants who don’t pay the rent on time for 5 plus years, they decide to sell. And we often buy these houses well under the current market value and far less than what they paid for them 7 years earlier.

To put this into perspective, in 2010/2011 we purchased many houses in QLD in Springfield Lakes and Redbank Plains area, in locations where investors paid between $370,000 & $430,000 for a 4 bedroom 2 bathroom home with double garage. Seven years later we purchased these houses for between $285,000 and $290,000.

Yes that’s right, those investors were losing over $100,00… and five to seven years after purchasing it.

Great deal for us, bad deal for them… That’s what we do!