Anchoring expectations – If you think the RBA is bluffing, think again…

Anchoring expectations – If you think the RBA is bluffing, think again…

The Reserve Bank of Australia surprised everyone on May 2ndwith a 25bps increase in the official cash rate, which now stands at 3.85%.

21 of 30 economists surveyed by Bloomberg predicted that, similar to April’s decision, the RBA would hold off on raising interest rates. Last week’s headline CPI figures, coming in lower than expected, did nothing to dissuade this view, even though the results were well outside the RBA’s target level of 2-3% inflation.

However, the RBA’s preferred measure of inflation is the “trimmed mean”. While this term sounds fancy, put simply, the RBA, when making its interest rate decisions, prefers to look through the “noise” of highly price volatile product (like petrol) and consider the price stability of a core set of good and services. Unlike the headline rate, the trimmed mean has not fallen as fast. Looking at the breakdown of good and services tells us why.

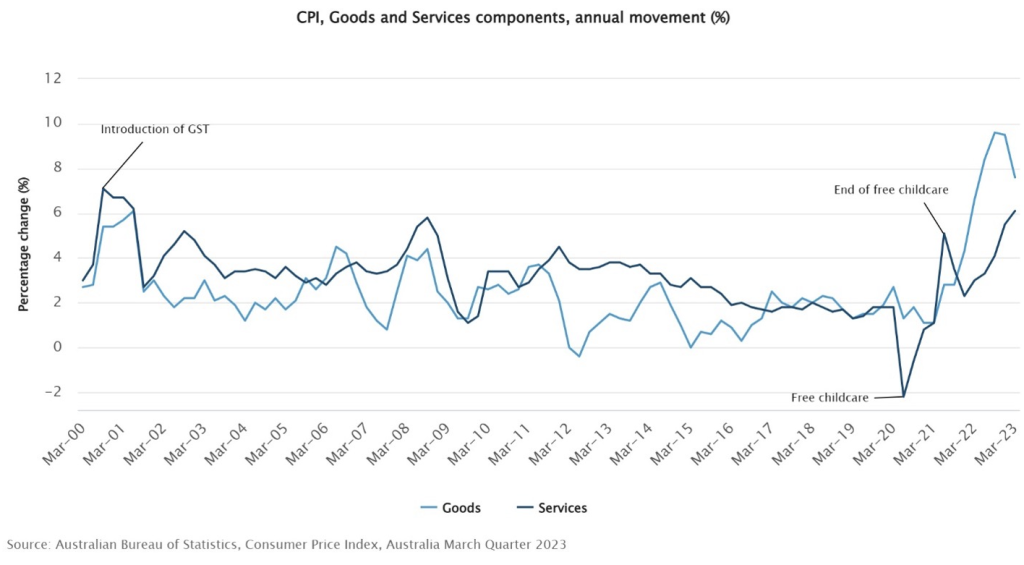

There has been a notable rotation from goods inflation to services inflation. “Goods” annual inflation eased to 7.6%, due to price declines in clothes & footwear, furnishings and appliances. “Services” annual inflation; however, continues to rise, driven by higher prices for holidays, medical services and rents. All of which should maintain the sense that any return of price inflation to the target level of 2-3% will be gradual, requiring continued monitoring by the RBA with “… some further tightening required to ensure that inflation returns to its target level in a reasonable timeframe”.

Managing household behaviour and especially inflation expectations was also an unusually prominent reason given by the RBA for raising interest rates. Inflation expectations can become a self-fulfilling prophecy. In theory, if people think prices will rise, they will ask for more money, which in turn leads to higher prices. As such, last months interest rate “pause” coupled with yesterdays rise has some “tactical merit”. It demonstrates that a “pause” does not mean a cut (as interpreted by some); it could equally mean more rises in the future, particularly given that “services” inflation traditionally lags behind “goods” inflation. In other words, elevated inflation levels are likely to be with us for some time.

Other reasons for the RBA to continue with interest rate rises include:

– Labour markets: Australia’s labour markets remainsextremely tight (unemployment is still at 3.5%) and wages growth is particularly robust at 3.3%. Wages continue to grow (3.3%), meaning labour costs are rising with the potential for wage-push inflation;

– Economic growth: While the outlook for the Australian economy was continued growth, there is continued uncertainty around consumption as interest rate rises: 1) direct people’s money from discretionary spending and towards mortgage and rent payments, and 2) supress wealth effects from declining house prices; and

– Global Outlook: Global growth is forecast to continue, even in the wake of bank failures in the US (First Republic, Signature Bank, SVB and Silvergate Bank) and Europe (Credit Suisse).

What does this mean for you, the everyday mortgage holder?

Well, based on the above, it looks like we are in for more pain with rate rises, so how do you combat this?

Fixed rates – the 3-year fixed rates for several banks have been reduced – talk to us if this suits you – perhaps locking in at a rate today that is sitting on par with the variable rates perhaps could secure your repayments – if you realistically cannot afford for your repayments to increase further.

If you have the cashflow to pay more now – talk to us about adjusting your repayments now. We can do the numbers with you and get your repayments increased to a repayment based on eg 6.5% so as rates increase you are ahead of the game – means your household budget is adjusted today.

Now could be the time to refinance and stretch out your loan term – if cashflow is an issue?

But, if you are looking to buy, don’t be deterred by getting into the market in a rising interest rate market, as an investor or a home buyer it’s about the long game, it’s about being smart with your purchase and buying what you can afford.

Talk to us if you need to work out the numbers – it’s a good idea to have these chats early if you think you need to change up your repayments – we want you to B financially happy always!